Hi, I’m Ed Wingfield

IRS Enrolled Agent & Tax Advisor

As an IRS Enrolled Agent (EA) and Tax Advisor, I will organize, minimize and prepare your taxes while making sure you are tax ready year-round! Book a free 15 minute tax consultation today. EA vs CPA?

Individual Taxes

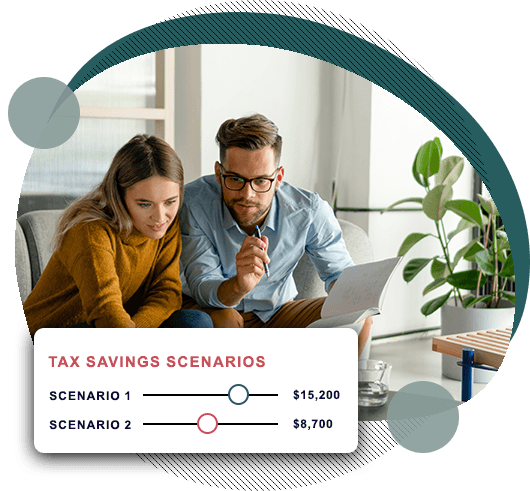

10%-37% or more of your income goes towards paying taxes each year. It’s your largest expense. We will help plan, strategize and prepare your taxes with the sole goal of putting that money back in your pocket!

Business Taxes

Whether you are a Schedule C, 1065 Partnership, 1120-S Corporation, etc., we will accurately prepare your tax return, help minimize you tax bill and ensures IRS compliance year-round. We give business owners peace of mind.

IRS Letters/Notices

Have you received an IRS letter, notice, bill or audit? As an IRS Enrolled Agent, we are trained in IRS Representation/Resolution. We will help you resolve your IRS issues in an efficient, affordable and professional manner.

“The feeling of being organized and tax ready is priceless. It’s a weight off my shoulders.”

– Sara Martinez – Denver, CO

“Working with Ed and his team has made tax time for me and my family a breeze. His service is 5 stars.”

– Lisa Smith – Lakewood, CO

“The difference between him and my last accountant is night and day. Highly recommend.”

– Tim Cortez – Aurora, CO

Enrolled Practitioners (EA vs CPA)

There are only 3 types of Tax Practitioners (licenses) that have unlimited representation rights before the IRS known as Enrolled Practitioners. Each one serves a different need/purpose. Tax Attorneys specialize in court matters, EAs specialize in taxation and CPAs specialize in accounting.

Tax Attorney

Expertise: Court Matters

You would engage a Tax Attorney if you have a tax issue that rises to the level of the US Tax Court, District Court or Supreme Court. Tax issues that don’t rise to this level (IRS letters, notices, audits, settlements, payment plans, etc.) may be more affordably handled by an Enrolled Agent. Additionally, if you are in a highly litigious industry or have entity structure concerns (liability exposure) these matters should be discussed with an Attorney. Attorneys must have a law degree and pass the bar exam which gives them the right to practice in a court of law.

IRS Enrolled Agent

Expertise: Taxation

Enrolled Agent is the highest credential the IRS awards (view on IRS website). EAs have full representation rights before the IRS just like Attorneys and CPAs. Unlike CPAs that specialize in accounting, EAs specialize in taxation offering the highest level of tax planning, tax preparation, and tax issue resolution. If lowering your taxes and staying IRS compliant are your biggest concerns (as a W2 taxpayer or small business owner), then an Enrolled Agent would be right for you. Many EAs have a Master’s Degree in Taxation and must pass the IRS Enrolled Agent exam (all 3 exam parts specific to taxation and IRS representation/resolution).

Cert. Public Accountant

Expertise: Accounting

You would engage a Certified Public Accountant if you run a business or entity that requires advanced or obscure accounting. As the name implies, their area of expertise is advanced accounting. Most small business get by just fine with a good bookkeeper or app but if your business is large, publicly traded, requires audited financials, advanced forecasting, inventory, etc., then a CPA might be right for you. Most CPAs have a Master’s Degree in Accounting and must pass the CPA exam.

Unenrolled Practitioners:

Unenrolled Practitioners are those tax preparers that do not posses the formal education, licensure and/or continuing education of an Attorney, EA or CPA. One does not have to hold a license to prepare taxes. If you are a mid-high income earner or small business owner and choose to work with an unenrolled preparer, you do it at your own risk. Additionally, because they do not hold one of the 3 licenses permitted by the IRS, they have little/no representation rights if the IRS comes knocking.

About Ed Wingfield, EA

Ed Wingfield is a Denver, Colorado native who is known for being very detailed oriented which is what makes him good at his job. Ed is an IRS Enrolled Agent and Tax Advisor who enjoys working with W2 taxpayers and small business owners to lower their taxes and ensure IRS compliance. He has a Bachelor’s Degree in Finance from Regis University (graduated with honors) and a Master’s Degree from Rutgers University (honors society) and completed is IRS Enrolled Agent training at the industry leading HOCK International. He has received numerous awards for his work both in business and for giving back to the community. When not working, Ed enjoys being an active father, golfing and reading a good book. If you are looking for a highly competent and motivated tax pro, book a call today!

Tax Prep for Individuals

Entrust your tax preparation to me, where precision meets excellence. With a deep understanding of the latest tax regulations and a commitment to maximizing your tax refund, I provide a seamless and stress-free experience. My goal is to make your taxes, an otherwise complex matter, one that you can understand and feel confident about. If you are a W2 employee, 1099 gig/contractor or K1 recipient, we will prepare and file your individual taxes in an timely manner with the primary focus on minimizing your tax liability.

- W2 Income Earners

- 1099 Gig/Contractors

- Shareholders/K1 Recipients

- Advanced Tax Reduction

- Preparation & E-File

- Peace of Mind!

Comprehensive Tax Review

Don’t pay $10,000-$30,000 for a tax plan! We’ll review your prior years’ returns for mistakes/savings and prepare a comprehensive tax plan at our going hourly rate.

Tax Prep for Businesses

Running a small business is challenging enough without the added stress of navigating complex tax codes. Our business tax preparation service is designed to take that burden off your shoulders. We specialize in helping small businesses like yours maximize deductions and minimize liabilities, ensuring you keep more of your hard-earned money. With our expert team staying up-to-date on the latest tax laws, you can trust us to handle your taxes with precision and care. Let us be your partner in financial success, so you can focus on what you do best—growing your business.

- Sole Proprietor/Schedule C

- Partnership Returns 1065

- S-Corporation Returns 1120-S

- Advanced Tax Reduction

- Preparation & E-File

- Peace of Mind!

Ancillary Business Services

Organized & Tax Ready Year-Round!

Bookkeeping

Professional bookkeeping is essential to ensuring you are IRS compliant and tax ready year round. It is also the key to formulating your tax strategy and minimizing your taxes. We will keep you books so that you can focus on your business.

Accurate and Ontime Payroll

Payroll

Payroll is a very complex undertaking that involves not only getting your employees paid on time but also frequent federal, state and local filing requirements. We will handle your payroll so that you can have peace of mind and focus on your business.

IRS Representation

Dealing with the IRS can be intimidating and overwhelming, but our IRS Presentation and Resolution services are here to provide you with expert guidance and peace of mind. We specializes in representing clients before the IRS, ensuring that your case is handled with the utmost professionalism and care. We work diligently to resolve your tax issues efficiently, minimizing stress and potential penalties. With our deep knowledge of tax laws and negotiation skills, we aim to achieve the best possible outcome for you. Trust us to be your advocate and partner in navigating the complexities of IRS matters, so you can focus on what truly matters to you.

- Filing Back Tax Returns

- Payment Plan Setup

- Settling IRS Debt/Fines

- Resolving IRS Letters/Notices

- Audit and/or Appeals Assistance

Contact Us

Ed Wingfield, EA

Phone: 720-297-1910

Alt Ph: 720-802-0055

Fax: 888-304-5081

Address: 7350 E Progress Pl #100

Greenwood Village, CO 80111